Everything Applicable Large Employers Need To Know About ACA Penalty Letters

Everything Applicable Large Employers Need To Know About ACA Penalty Letters

Everything Applicable Large Employers Need To Know About ACA Penalty Letters

In this blog post, we will review the following:

- The Law: 4980H, 6055, and 6056

- Who is Responsible?

- Penalties Commonly Used for ACA Non-Compliance

- Penalties Less Often Used for ACA Non-Compliance

- IRS Letters

- What Employers Should Do When Receiving an IRS Letter

- Triggers for Letters Anticipated To Increase

- Common Mistakes Leading Up To a PTC or IRS Letter

The Law: 4980H, 6055, and 6056

The Internal Revenue Code 4980H details the Employer Shared Responsibility Provisions (ESRP), which mandate applicable large employers (ALE) to offer health care benefits to 95% of their full-time equivalent employees and their dependents. This offered plan must meet minimum essential coverage (MEC), minimal value (MV), and affordability thresholds. If a full-time employee receives a premium tax credit (PTC) from the Marketplace and enrolls in coverage, their employer then shares responsibility for the cost of that coverage. 4980H(a) details the consequences if an ALE does meet MEC requirements, and 4980H(b) describes the outcomes if an ALE complies with MEC requirements but does not meet the thresholds for MV and affordability. In addition, §6055 and §6056 require all entities providing MEC coverage to file a return reporting such coverage (form 1095b) and every ALE following the requirements of 4980H to file a return reporting those details (form 1095c), respectively.

Codes 6055 and 6056 are instrumental, being they require reporting to the IRS for the IRS to confirm and enforce requirements of 4980H. Essentially, this forces the IRS to be the silent mortgage investment partner to all ALEs regarding their healthcare offerings.

Who is Responsible?

ALEs and employers offering a self-funded plan, regardless of size, must comply with the Employer Mandate.

Penalties Commonly Used for ACA Non-Compliance

With multiple avenues in which the IRS could enforce penalties related to the Affordable Care Act, to date, they have only utilized the following:

- 4980H(a) Penalty

- When an ALE does not offer MEC to 95% of their full-time employees, they violate 4980H(a), resulting in the most significant ACA penalty as it uses the total count of 1095 forms filed by the employer for that reporting year. If an ALE did not report for ACA, the IRS uses their W2 count for the 4980H(a) penalty calculation. For 2023, the 4980H(a) penalty amount is $2,880 annually per employee, multiplied by the number of 1095c forms filed minus the automatic 30-employee exemption. Imagine ABC Upholstery, who employs 100 full-time employees, did not realize they grew and became an ALE in 2021; subsequently, they did not file 2023 ACA reporting, resulting in a $201,600 penalty.

Calculation: $2,880 x (100-30) = $201,600

- 4980H(b) Penalty

- The 4980H(b) penalty is issued when an ALE has met the MEC requirements, but the plan is not affordable or does not meet minimum value. Unlike the 4980H(a) penalty, this penalty computes individually when a PTC is redeemed by one of the employer’s full-time equivalent employees enrolled in coverage. The 4980H(b) penalty for 2023 is $4,320 annually per employee. Bob’s Staffing Agency only offers a MEC plan to all employees on the day of hire. Three full-time employees at Bob’s Staffing Agency went to the Marketplace and enrolled using PTCs. At the end of 2023, the Marketplace reports these PTCs to the IRS, which cross-references the 1095c forms filed by Bob’s Staffing Agency. Confirming that the 4980H(b) penalty is appropriate since a MEC plan was offered and protected Bob’s Staffing Agency from the more expensive 4980H(a) penalty; therefore, Bob’s Staffing Agency owes $12,960.

Calculation: $4,320 x 3 = $12,960

The IRS may not assess both “A” and “B” penalties for the same month to an employer, and the monthly “B” penalty may never exceed what the “A” penalty would for the same month.

- 6721 Penalty

- This penalty is familiar for those having filed with the IRS, as 6721 allows the IRS to assess a penalty when an information return or statement is not timely or correctly filed by the due date of the return. Currently, the IRS utilizes the convenient portion of this law regarding ACA deadlines, issuing annual amounts for late fees. ACA reporting late fees increase at 30-day increments up to the maximum of 90 days. For 2023 the maximum late fee amounts to $280 per 1095 form. For those ALEs that failed to report past-year filings, penalties can be significantly reduced by filing, especially for the 4980H penalties. However, doing so outside the deadline may lead to the maximum amount for that year, $3,392,000.

Penalties Less Often Used for ACA Non-Compliance

- 6721 & 6722 Penalty

- This penalty is for failure to furnish correct information returns or payee statements. For ACA, this would be the distribution of the 1095c forms to employees by the deadline, which for 2023 is March 2nd or filing returns with incorrect information. The 2023 amount is $280 per form penalty with a maximum amount of $3,392,000 annually.

- 6662 Penalty

- This penalty is for “negligence” or failure to reasonably comply with the law's provisions, including careless, reckless, or intentional disregard of the information reported. The 2023 amount is $280 per form penalty with a maximum amount of $3,392,000 annually.

- 6694 Penalty

- This penalty appears if the preparer of information completes inaccurate reporting.

- 6699 Penalty

- This penalty is due to missing or inaccurate reporting regarding an aggregated member. The 6699 Penalty is triggered directly from the 1094c Form, Part IV, where an employer should list the Aggregated Member in order of size from largest to smallest.

The Inflation Reduction Act of 2022 is a 10-year plan that funds the IRS with 87 billion dollars for improvements in their services and technology, which will likely result in stricter adherence to compliance requirements.

The above list is not an all-encompassing list of penalties that the IRS could use to assess penalties for matters relating to the ACA, being there is no Statute of Limitations for ACA Reporting.

Having reviewed the law and sections on which non-compliance could be linked, we can now outline the various letters of communication the IRS uses to provide warnings, penalty assessments, or receipts to employers.

IRS Letters

(listed in the sequential order a recipient would expect)

- Letter 5699

- The Missing Information Return Form 1094/1095-C Letter makes initial contact with the employer, giving a reason for the communication, general information about employer requirements, and instructions for responding.

- Letter 5698

- It is issued when there is no response to Letter 5699 within the allotted time. Without a response to Letter 5698, the IRS pursues Failure to File and Failure to Furnish penalties.

- Letter 5005-A

- The Information Return Penalty Cover Letter is issued once a case has been examined and assessed a penalty for failing to distribute or file their ACA forms. Accompanying Letter 5005-A will be Form 886-A which explains items reviewed and penalized to inform the employer of the facts, law, and conclusion of their decision.

- Letter 5840

- The Information Return Closing Letter, which all employers hope to receive, states that their response was sufficient, no more action is required, and the case is closed.

- Letter 6145

- Employer Shared Responsibility Payment (ESRP) Additional Information Letter confirms receipt and review of the employer’s response but concludes that the penalty still applies.

- Letter 226J

- The ESRP Preliminary Contact is issued when a full-time equivalent employee receives a PTC for at least one month within the reporting year; therefore, the ALE is liable for ESRP. Letter 226-J will also include; an ESRP Summary Table, itemizing the Proposed ESRP, Form 14764 for the ESRP response, and Form 14765 listing the employee PTCs issued compared to the 1095 codes reported by the employer by month. The employer has three options upon receipt of Letter 226-J with a deadline of thirty days from the issue date: no response, agreement to the proposed ESRP, or partial/total disagreement with the determined ESRP.

- Letter 5040-J

- The Follow Up Letter is issued when there is no response from the employer to Letter 226-J. There is a fifteen-day response deadline for Letter 5040-J.

- Types Of 227 Letter (J-N)

- Letter 227 is an ESRP Acknowledgement Letters provide a receipt of your response and options for the next steps from the IRS.

- Letter 227-J acknowledges receipt of the signed agreement form and informs the employer that the ESRP will remain and the case will be closed; consequently, no response is required.

- Letter 227-K acknowledges receipt and acceptance of the employer’s response, confirms that the proposed ESRP has been reduced to zero, and indicates the case will be closed; therefore, no need to respond.

- Letter 227-L acknowledges receipt and partial acceptance of the employer’s response, confirms that the proposed ESRP has been reduced, and provides an updated form 14765, allowing the employer to agree, disagree, or request an appeal.

- Letter 227-M acknowledges receipt of the employer’s response, confirms that the proposed ESRP will remain unchanged, and provides form 14765, allowing the employer to agree, disagree, or request an appeal.

- Letter 227-N acknowledges the decision of the Independent Office of Appeals and provides an updated ESRP amount to the employer. This letter is final, and no response is required.

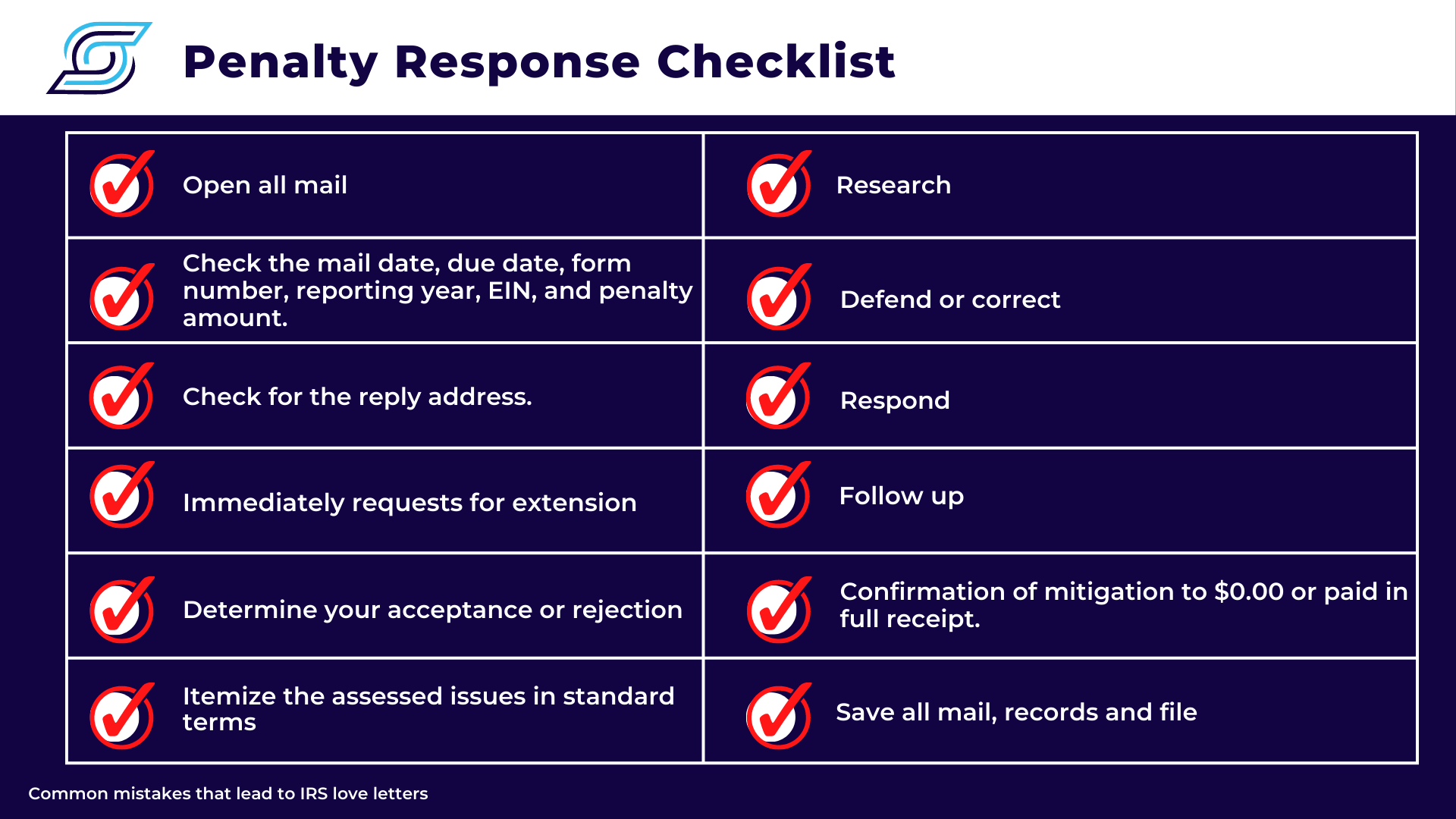

What Employers Should Do When Receiving an IRS Letter:

The IRS Letters previously mentioned provide descriptions and consequences when an employer fails to comply with the Employer Mandate. These letters are mailed in non-descriptive plain white envelopes and written using IRS jargon, making them difficult to read which can be overwhelming to employers. Having assisted many employers stamped with an IRS Letter, here are the best practices ALEs must adhere to once they find themselves in this situation:

- Open it. It is not junk mail; Don’t let the IRS letters get filed to the side and forgotten about until the 24th hour before the response deadline.

- Identify the type of Letter printed on the top or bottom right-hand side of the letter.

- The date of Notice, Tax Year, EIN, and Response Date is often at the top right-hand side of the letter.

- The reason for the letter, the proposed ESRP amount, and what the employer must do in the first couple of sections of the letter.

- Confirm and review supporting documentation provided for backup. This information appears within the final pages and details the PTC trigger, itemizes each proposed violation, and provides penalty calculation with numbers if applicable.

- Check for the reply address.

- Request for an extension immediately, even before confirmation of the supporting information the IRS provided.

- Contact SyncStream Solutions, as it is best to have guided support from ACA subject matter experts.

- Review the infractions and supporting documentation.

- List the infraction in your terms.

- Determine your acceptance or rejection.

- Complete your due diligence and research each infraction thoroughly.

- Defend or Correct your reporting or actions in question.

- Respond appropriately using the instructions and forms provided within the letter.

- Follow Up with the IRS using the number provided. It is best to call first thing in the morning, 7 am Eastern Standard Time.

- Confirm your acceptance of the IRS response or move the appeals process.

- Save all records, notes, timestamps, and files in the folder for that EIN by reporting year.

Triggers for Letters Anticipated To Increase

Remember, Premium Tax Credits are the main trigger for an ACA penalty. When an employer’s full-time employee receives a PTC, even for one month, the Marketplace reports to the IRS creating a case for a potential liability. The IRS cross-references the Marketplace’s reporting with the employer’s 1095C reporting for that year and determines if the employer failed to comply with the Employer Mandate. Additionally, the IRS confirms there is no statute of limitations on the ACA penalty, which means they can go back to your 2015 reporting and reassess penalties or create new ones, such as accuracy.

Common Mistakes Leading Up To a PTC or IRS Letter:

- Inappropriate or inconsistent ALE calculation

- Failure to file

- Inaccurate filing

- Failure to meet the 95% threshold for offering a MEC plan to full-time equivalent employees

- Inaccurate calculations for employee status, affordability, breaks in service

- Not offering a plan that meets affordability or minimum value standards

- Clerical error

- Misinterpretation of coding for 1095 forms

- Consistency from year to year

- Procrastination

- Confirmation of accurate source data

- Using various software platforms to prepare, populate, and file reports

- Change and implementation of procedures identified as issues in previous reporting years

- Having an ALE executive member attest to the information populated on the forms

- Not opening the mail

These known triggers that have led to issued letters will increase. This year is the 10th anniversary of the Marketplace, which recorded the highest enrollment numbers across the board, with over 16 million lives enrolled as of January 15, 2023, confirming the increase in PTCs for the 2023 reporting. The IRS will send letters for the PTCs used to fix the Family Glitch so that affordable coverage would be accessible to spouses and dependents. Continuing to update the regulations, increasing complexity each year, annual increases to thresholds and penalties, fixes that create new issues, the Family Glitch, and the anticipated enhancements from the 87 billion dollars allocated to the IRS over the next ten years, all employers should be on notice. Stakes are rising each year as the burden of proof remains with you, the employer.

About SyncStream:

SyncStream maintains a tenured, knowledgeable staff who continually monitors changes to the employer mandate regulations and updates solutions as laws evolve. SyncStream removes the burden of ACA compliance and provides penalty risk assessments and suggested corrections to reduce your company’s risk of high IRS penalties. Subject matter experts utilize SyncStream’s user-friendly compliance software to track employee hours, auto-populate forms, audit forms, and e-file for thousands of ALEs. SyncStream’s Full Service Total ACA solution can simplify your ACA compliance needs.