Avoiding the Five Most Common ACA Reporting Errors

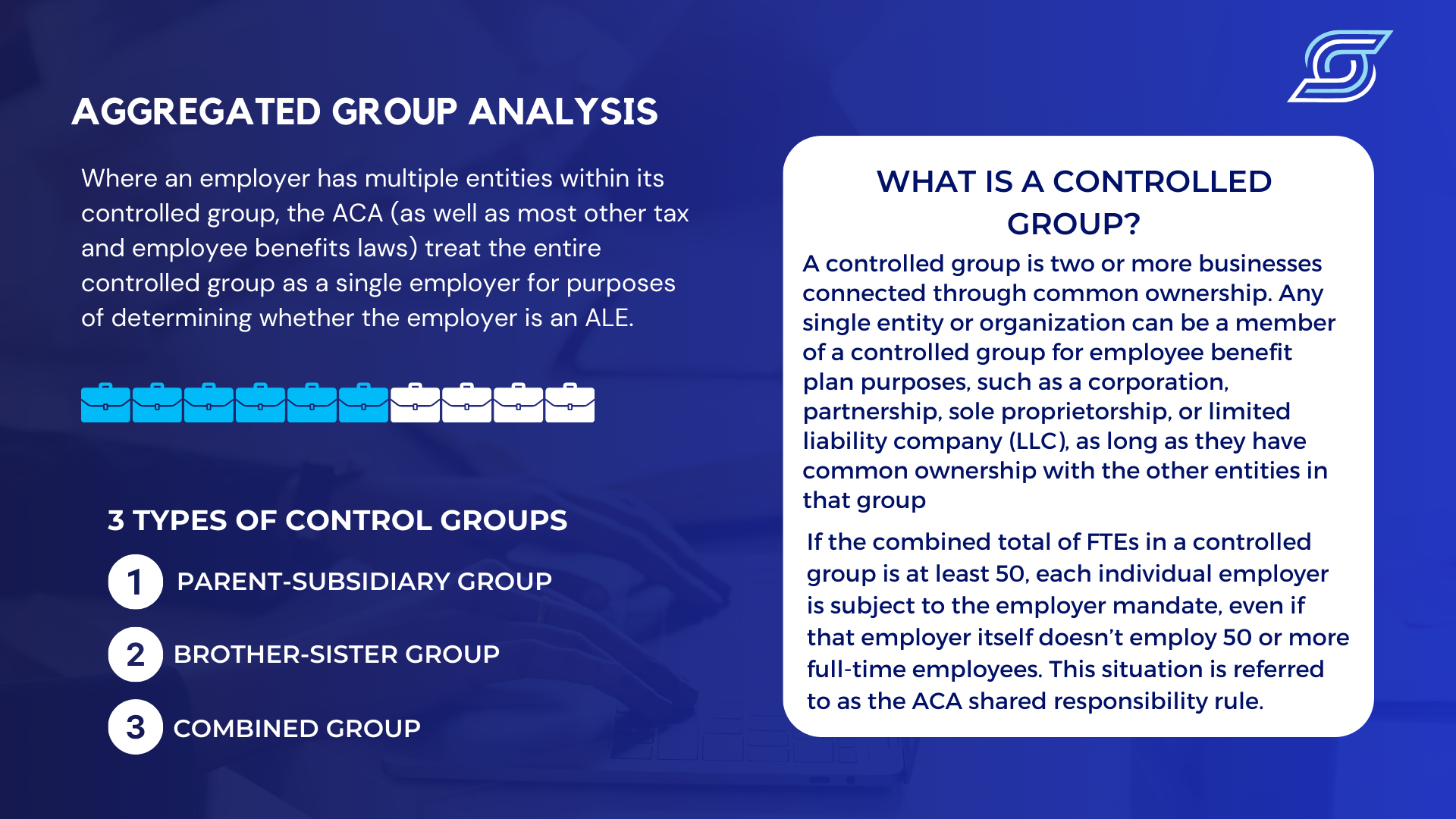

1. Failure to Perform an Aggregated Employer Group Analysis

When an employer has multiple entities within its controlled group, the ACA (as well as most other tax and employee benefits laws) will treat the entire controlled group as a single employer to determine whether the employer is an applicable large employer (ALE).

A control group or (aggregate group) is two or more businesses connected through common ownership. Any single entity or organization can be a member of a controlled group for employee benefit plan purposes, such as a corporation, partnership, sole proprietorship, or limited liability company (LLC), as long as they have common ownership with the other entities in that group.

If the combined total of full-time employees (FTEs) in a controlled group is at least 50, each individual employer is subject to the employer mandate, even if that employer itself doesn’t employ 50 or more full-time employees. This situation is referred to as the ACA shared responsibility rule.

This common error also includes incorrectly reporting employees who work in multiple locations.

If an employee is working for two separate employers that are part of an Aggregated ALE Group, then that employee’s hours must be aggregated to determine whether they were full-time. Also, one location has to take the brunt of the reporting requirement.

2. Employees Are Not Properly Classified

Accurately determining the ACA status of your employees relies on properly classifying them as full-time, part-time, seasonal, or variable hours. For instance, an employee who is hired with the expectation of working 30 or more hours each week should be designated as full-time for ACA compliance.

While you might have previously considered 40 or more hours per week as the threshold for full-time employment, the

ACA sets the standard at 30 hours. Confirming that you have properly tracked and calculated your employees' work hours to determine ACA employee status will minimize reporting mistakes.

There are different employment classifications:

- Full-Time- FTEs work an average of 30 hours or more per week, or at least 130 hours in a month.

- Part-Time or Variable Hour- A variable-hour employee is one whose hours are uncertain or irregular, making it difficult to determine whether they work at least an average of 30 hours per week.

- Seasonal or Temporary- A seasonal employee is defined as an employee who works in a position for which the customary annual employment period is less than 120 days. Temporary refers to the nature of the position, which typically involves work for 6 months or fewer, and the period of employment typically begins at about the same time each calendar year, such as winter or summer.

Frequently, employer databases store outdated or inconsistent employee information. The consequences of misclassifying employees can lead to missed coverage opportunities for eligible individuals.

To address this concern, perform regular reviews of employee data across various systems, including payroll, timekeeping, and benefits databases. It is essential to maintain current information. This monthly practice will streamline ACA reporting for each annual period.

Please refer to our eBook, “Navigating ACA Compliance” for a complete overview of these classifications.

3. 1095-C Form Errors, and Mismatched Indicator Codes

The 1095-C form, Part II (Lines 14-16), provides a month-by-month breakdown of critical information, including details about the coverage offered to an employee, the recipient of the offer, the cost to the employee for self-only coverage, and any applicable safe harbors or employer-provided relief.

This form can be confusing, and vital sections are frequently left blank when that is prohibited.

Other common errors include invalid code combinations and misidentification of self-insured and fully insured plans.

- A fully insured health plan is the conventional approach to employer-sponsored health plans and is widely recognized by employees. Employers pay a fixed premium to a third-party insurance carrier that covers medical claims.

- Self-insured plans are employer-funded and managed, often used to control health insurance expenses. The employer collects premiums from enrollees and takes on the responsibility of paying employees' and dependents' medical claims. The employer is the insurance provider, so it will send out the 1095-B forms.

Presently, there are 90 possible combinations of indicator codes for Lines 14 and 16, with slightly over half of these combinations being valid. For instance, a combination like 1H and 2C is entirely invalid because 1H signifies that no offer of coverage was extended, while 2C indicates that an employee actively enrolled in coverage.

Failing to grasp the intricacies of these indicator codes and their interactions can result in the creation of flawed forms, inviting increased scrutiny and potential penalties from the IRS.

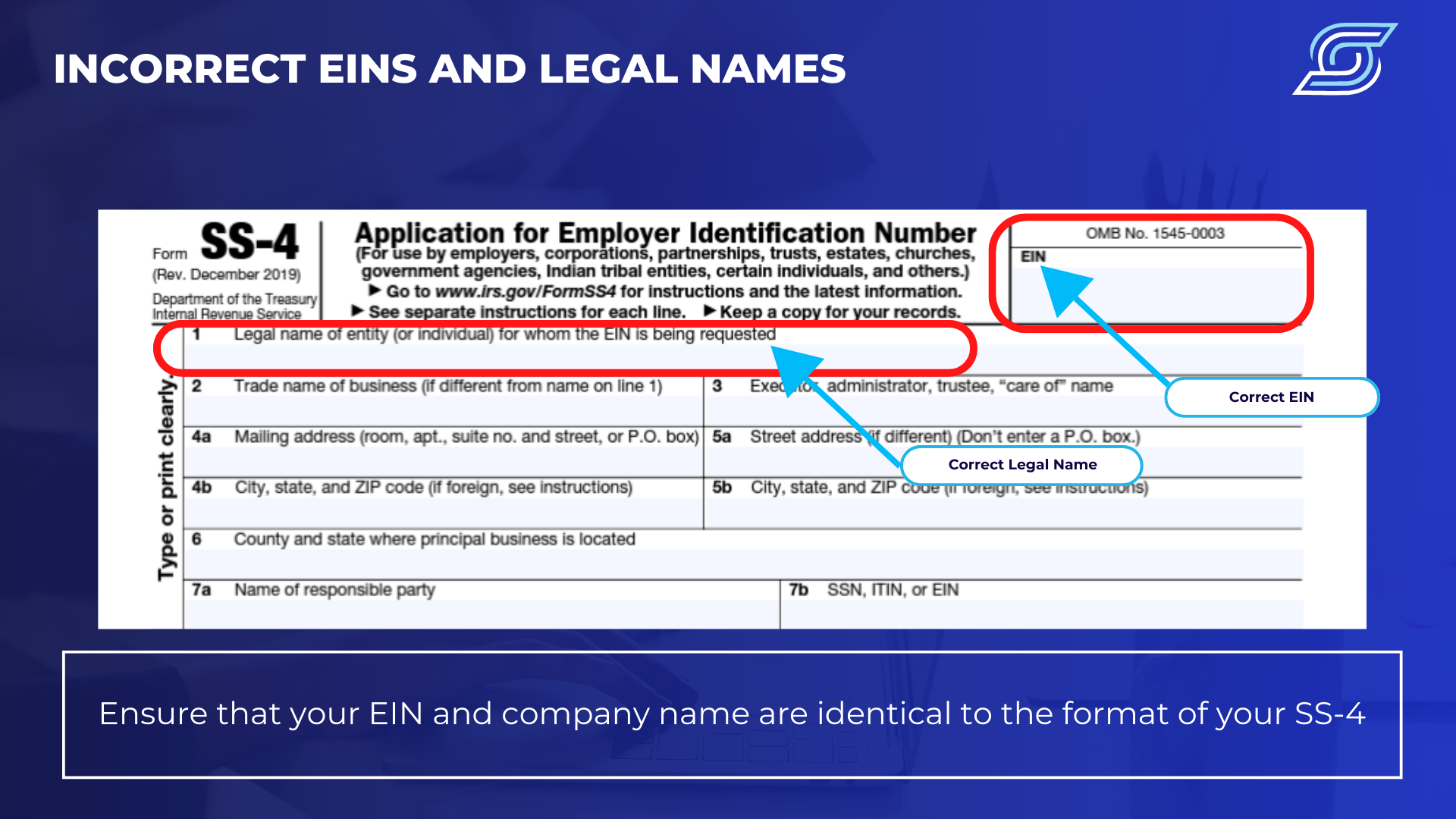

4. Incorrect EINs and Company Legal Names

One of the most common mistakes is a mismatch between the employer identification number (EIN) and the legal name of the company. Review EINs and legal names before submitting to the IRS, checking for misspellings, improper characters, and ensuring the EIN and company name are identical.

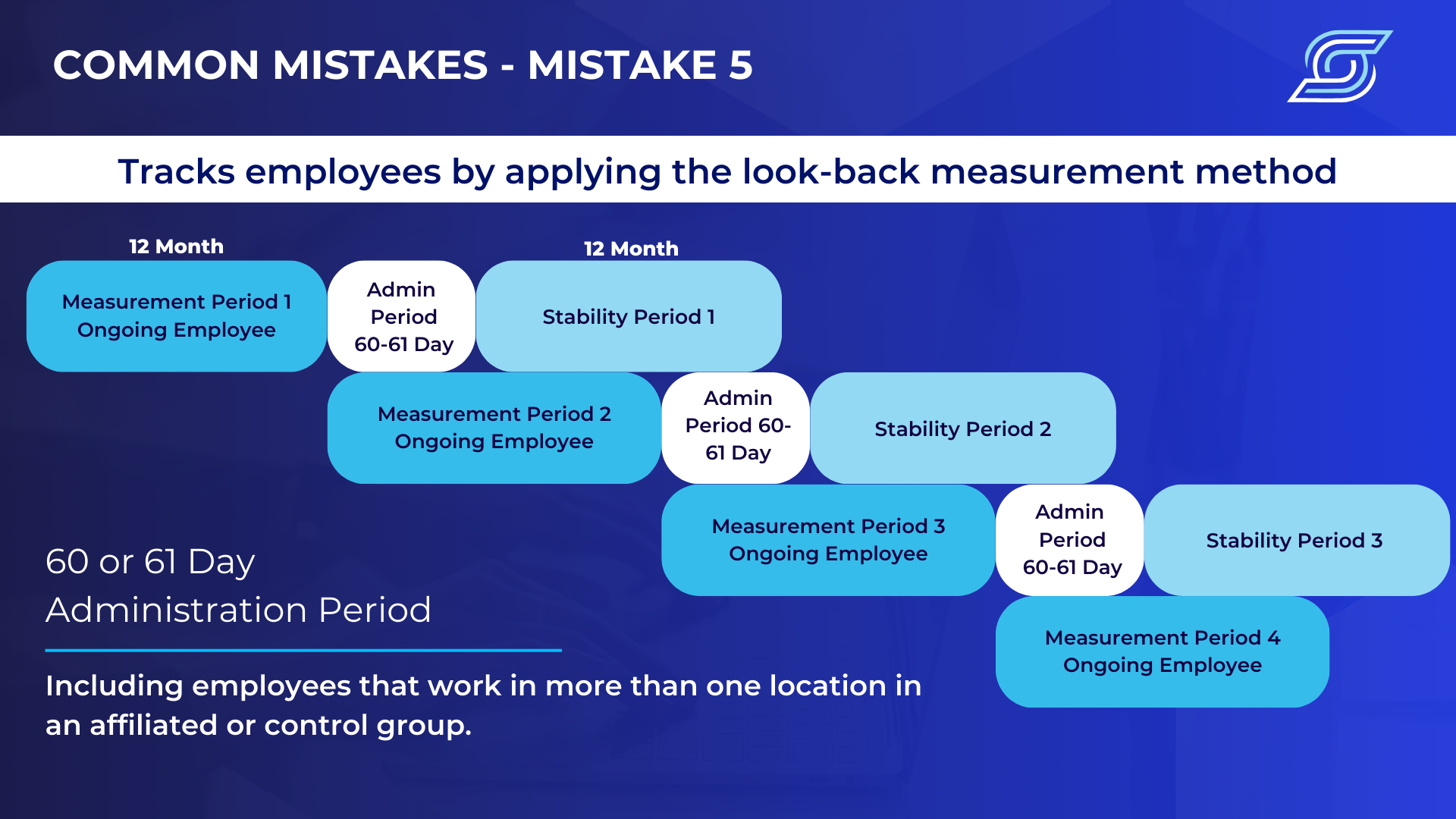

5. Improper Application of Measurement Period Methods

As an employer, you will need to determine FTE hours using either the “monthly” or the “look-back” measurement method. Choosing the incorrect method can result in gaps in coverage and noncompliance that can result in a penalty.

- Monthly Method- Under this approach, the employer can calculate an employee’s hours on a month-by-month basis. If an employee works at least 130 hours each month or at least 30 hours per week in a calendar month, they are an FTE. Hours of service also include paid time off, such as for sick time, vacation time, jury duty or leave of absence.

The Monthly Measurement Method is better suited for organizations with predominantly stable, full-time employee workforces, offering a simpler framework.

- Look-Back Method- Under this method, the employer can figure the number of hours an employee worked in the preceding period. Companies cannot use this approach to determine whether a worker is an FTE for defining ALE status.

The Look-Back Measurement Method is ideal for businesses with highly variable hour workforces, such as those in the restaurant, construction, hospitality, and education industries.

Also, make sure there is accurate reporting of employement periods that include new hires, rehires, termination dates, and breaks in service in payroll data.

Please consult our downloadable resource covering " Seven Common ACA Reporting Mistakes ".

About SyncStream

SyncStream maintains a tenured, knowledgeable staff who continually monitors changes to the employer mandate regulations and updates solutions as laws evolve. SyncStream removes the burden of ACA compliance and provides penalty risk assessments and suggested corrections to reduce your company’s risk of high IRS penalties. Subject matter experts utilize SyncStream’s user-friendly compliance software to track employee hours, auto-populate forms, audit forms, and e-file for thousands of ALEs. SyncStream’s Full Service Total ACA solution can simplify your ACA compliance needs.